From Classroom to Competition: A STEM Teacher’s Journey to Top National Rankings

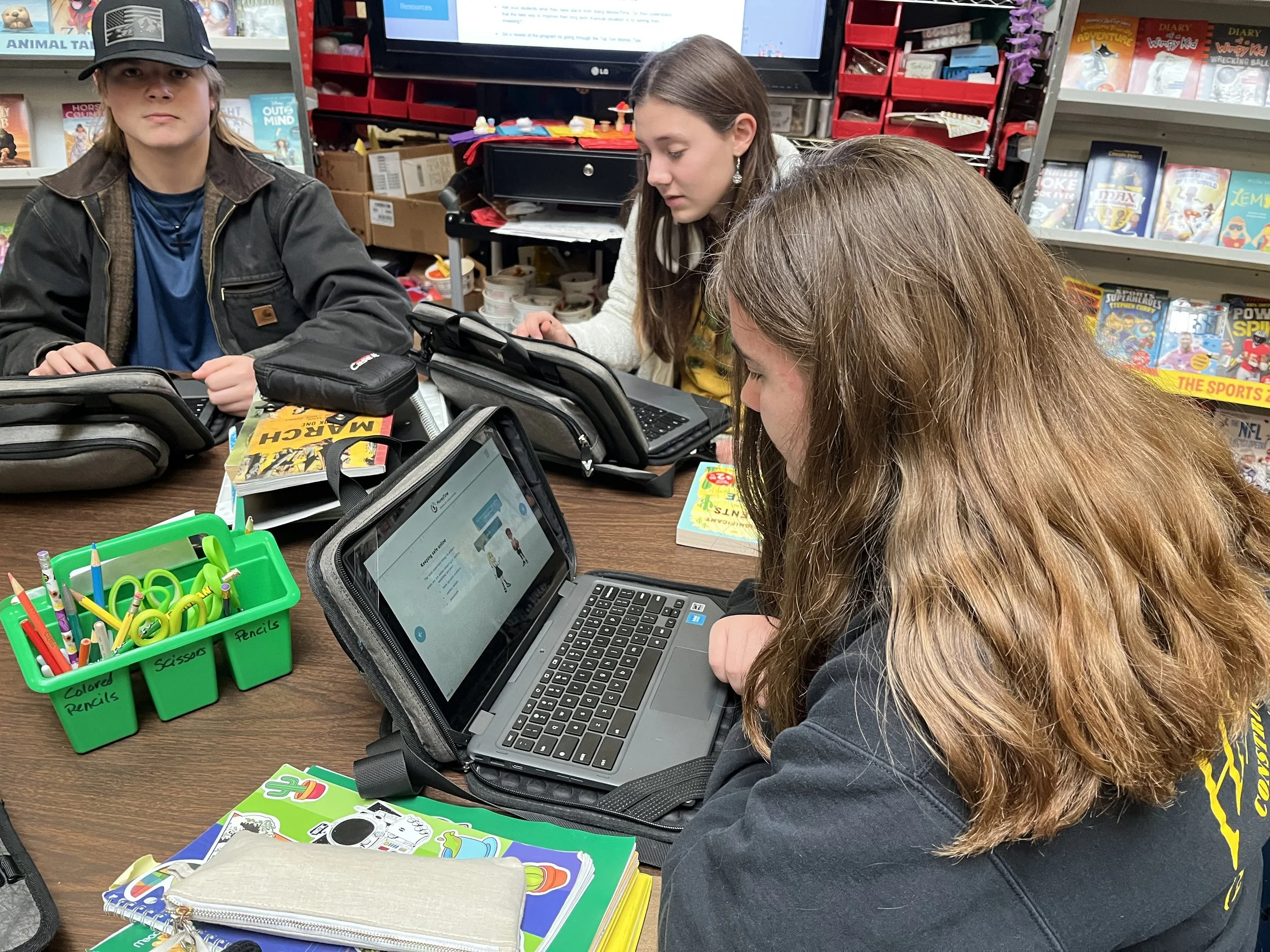

Clarissa Howard, a middle school STEM teacher and Learning Commons Guide at Whitefield Elementary School in Maine, transformed her 7th and 8th-grade students’ understanding of money using MoneyTime. Delivered over a three-month trimester and used twice a week, the program became a favorite for both Clarissa and her students. Their enthusiasm led to two of her classes climbing into the top four in the nationwide MoneyTime Interclass Competition 2024!

Clarissa had originally found MoneyTime while looking for a way to bring real-life money skills into her classes. “I got an email, and I was already planning to do a financial unit,” she says. “I’d tried a few online options in the past, but when I saw MoneyTime had smaller modules, I thought, this looks good. It covers everything, even mortgages!”

“I was pleasantly surprised that each module was short (15-20 minutes) - just the right length. Kids don’t have long attention spans, so it was great that they could pick up the lesson and move on.” Clarissa mentions.

Among the students in her class was Chiara, a 14-year-old who, like many of her classmates, didn’t expect to come out of the unit with such a solid grasp on real-world money topics. But four months later, Chiara had completed all 30 modules and felt better prepared for her financial future.

Chiara agrees the program was approachable, despite the wide range of financial topics and content depth: “MoneyTime made it pretty easy to understand. Definitely better than I had before.” Even complex topics like collateral and repayments stuck with her: “It might take me a moment to remember, cause it’s been a little while, but I think yes.”

It didn’t take long for Clarissa to see the results were impressive. Her 8th graders averaged a 66% increase in financial knowledge, well above the 42% program average. “I actually expected them to get more,” she says with a smile. “Chiara was the first to finish everything—she took her Chromebook home and just got it done.” Chiara’s example inspired the other students. “When I showed them the leaderboard and she was at the top, it motivated the rest of the class. I said, ‘She’s done it all, and you’ve all had two extra months!’” Clarissa laughs.

Making Time For Money in a Flexible Curriculum

Clarissa teaches STEM and financial literacy. Her flexibility is rare: “I’m one of the few that does a money unit, I think it’s important. I try to give kids things they might not get in high school. Money is one of those things.” At Whitefield, she teaches 34 students in her financial unit and sees her 7th and 8th-grade groups twice a week for 45 minutes. “I also have the library, so I combine in some literacy. I’ve taught AI, computer science, and I used to run a stock market unit. Now I run MoneyTime.”

Seamless Setup With Google Classroom Integration

Implementing MoneyTime was refreshingly easy for Clarissa. Despite having access to a single sign-on platform, she opted to use Google Classroom for simplicity and student familiarity. “It was pretty seamless for the kids. I mean, they were up and running within probably two minutes, not even that,” she shared. “Even my third graders know how to do this. I put the class code on the board, they follow the link, and they’re in.”

Flexible Pacing

To help guide her class, Clarissa initially unlocked modules in chunks. But as students grew more confident, many wanted to work ahead. “After around the 10th module, kids were saying, ‘Hey, we want to go ahead!’ Eventually, I just started unlocking more and letting them progress at their own pace.” Her 8th graders largely stayed on track independently, while her 7th graders had more variance—showing the value of differentiated pacing.

Using the Module Guides for Real-Life Discussion

She also leveraged the teacher module guides for meaningful discussions. “I’d put the module guide up on the screen so they could see it. We’d talk about vocabulary—‘deposit’, ‘withdrawal’, real-life stuff. I’d ask, ‘Who here has a savings account?’ That made it all click for them. I’d ask, ‘So what do you do with your money?’ and more questions where they could relate to what was going on in the modules.” Some lessons even became full-class conversations. “We spent a whole 40-minute class on the paycheck example, because they had so many questions about state income tax and how to get their money back. They’d ask, ‘How do we get the money back then?’. And I’d say, ‘Well, every April we have to do our taxes, and this is how you always get your money back.’ So it would go off into other areas of personal finance, but it was a great area that they needed to learn about.

Self-Directed Learning With Real Impact

MoneyTime’s self-paced nature was a big plus. “It’s self-directed, which is what we’re really trying to promote - having students motivate themselves,” Clarissa explained. Chiara echoed this sentiment: “I personally like reading quite a bit, and I found the content really interesting.” She used the program helper notes to help herself stay on track: “Yeah, I would always glance over the helper notes, just to make sure I got everything.”

Clarissa also noticed how MoneyTime changed her students’ outlook. “Some students really took it seriously. They told me they’re going to start saving, which was great to hear. It made them reflect. They realized that this stuff is coming soon. I said to them, ‘Jobs, rent, oil changes, insurance, it’s only two years away.’ Then their eyes got big. And they're like, ‘Wow. It’s only two years.’ I said, ‘Yeah. Mommy and Daddy won’t be paying for it.” She recounted one student asking, “How did you learn all this, Mrs.?” and replying, “Honey, I’m old— I've been living it. You're young, you're learning it now.”

Financial Awareness Through Gamification

Gamification played a big role in student engagement. Chiara enjoyed the avatars: “I thought they were cool. It's a fun way to customize. I know that some of my classmates got really into customizing their avatar.” And then came the lesson many kids only realize once it’s too late: “They realized they were spending money, which reduces their wealth,” she laughed.

Clarissa says the gamification helped the students to become savvier. “I appreciated how the program brings in real-life scenarios. The kids know it’s a game, but when there’s a leaderboard involved, some really got competitive—saying things like, ‘I'm not spending anything, I want to climb the ranks!’”

It was interesting to see their career choices, too.” Some were surprised at the costs associated with certain jobs. Clarissa explained, ‘If you want to be an astronaut, you’ve got to go to college. Same for being a teacher.’ I told them, ‘If you get a good-paying job and stick it out, you can save enough to do what you want later.’ That’s part of the choices they make in real life that the program teaches.”

For Chiara, one of the most eye-opening parts of MoneyTime was seeing how investments can rise and fall, just like in real life. “It shows how things fluctuate, so you get the real sense for how things won't go just straight up or straight down.”

This came into play most noticeably in the Invest tab, where students manage virtual investments like property, business, collectibles, and more. She experienced some wins, especially with property investments. “I got a really nice long up,” she recalled with a smile.

But the program didn’t shy away from the risks either. “Right at the end, actually, my investments went down a little bit,” Chiara admitted. That balance between gain and risk was a key takeaway. “I avoided business… I was worried I’d invest a whole bunch and then it would just drop suddenly because it was high risk.”

Leaderboard Motivation and National Recognition

“I liked that there was a leaderboard. Around the fifth or sixth module, they realized they were moving up and down the rankings.” Clarissa said. “I explained that if you spend your money, your wealth goes down - investing is key. I gave them examples from my life - what I earned when I worked, what things cost then versus now. I told them, ‘You're going to make more, but life is going to cost more, too.’ These conversations were exactly what I hoped for. I wanted them to understand that money doesn’t just come from their parents - they’ll be earning it and need to know how to manage it. When I saw how the modules were structured, I thought, ‘This is perfect—it’ll last us 15 weeks until Christmas.’”

The national leaderboard boosted motivation. “I told them, ‘Guys, this is big. It’s not just Maine - it’s everywhere!’ I’ve done in-school competitions before, but when they saw they were competing with kids from other schools, that added a new level of excitement; it just made it seem bigger to them.”

At the time of writing, her 8th graders were ranked 1st nationally, and her 7th graders held 4th place. “That was a fun moment. It made the experience feel bigger and more important.”

Clarissa also praised the scoring system and the way it tracked student progress instantly: “Kids could see their results instantly. Some tried retaking quizzes for better scores, but I reminded them—‘I’m taking your first score!’ It encouraged honest learning.”

Reflections and Takeaways for Future Use

Clarissa had introduced the program with a real-world warning: “When I began this unit, I prefaced it to the students. In a couple of years, you're going to be getting a job, and you'll think you're making all this money - until taxes get taken out. I wanted them to understand money because they’ll soon be earning it. Some kids I know get their first paycheck and are shocked: ‘They took all this stuff out!’ I want my students to have at least a basic understanding so that even if they forget some of it now, it will come back to them later. I did expect a higher class score overall, but I think they gained the understanding I was aiming for.”

If you ask Chiara, that goal was met. “Yeah, I think I’ve got a reasonably good understanding now,” she reflected. "I finished MoneyTime a little bit ago," they shared proudly. "I think I’d be pretty motivated to do it again. It'd be a nice refresher just to make sure I remember everything better."

A program worth recommending

“I think it would be smart for other teachers to use MoneyTime. It’s a time-saver, it gets straight to the point, and each module can be completed in one class period. Even if you’ve only got 30 minutes, you can have a brief discussion and still finish the module.”

MoneyTime’s positive impact extended well beyond the classroom. “I mentioned it to other schools in my district—there are four others with my role—and they liked the sound of it. I said, ‘It’s free and it’s self-directed. Check it out.” Clarissa is already thinking about how to use it again: “It worked really well. The kids were engaged. They learn how to add decimals and dollars in math problems, but they rarely get real-life context. MoneyTime gave them that real-world perspective. They learned something they’ll use for the rest of their lives. That’s what I want from my classes.”

Her thoughtful implementation of MoneyTime highlights just how effective the program can be in teaching financial literacy in a way that’s relevant, fun, and empowering. Her students didn’t just complete modules - they asked questions, reflected on their choices, and even began applying concepts to their lives. As Clarissa put it, “They’re only two years away from getting jobs and paying bills. Now they actually understand what that means.”