Home education financial literacy curriculum

MoneyTime is an online financial literacy programme for children ages 10 to 15 that is 100% localised as a home education curriculum for the UK.

Teaching financial literacy to your child

Are you worried your child will grow up not being financially capable?

That they will still be financially reliant on you when they leave home?

Many schools don’t teach personal finance, they don’t think it’s important enough or they cant’ fit it in.

So it’s up to you.

But what do you teach them? And how do you make it fun?

Home-ed financial literacy made easy

MoneyTime has solved those problems for you. You don’t have to have strong financial literacy yourself, or do any teaching if you don’t want to.

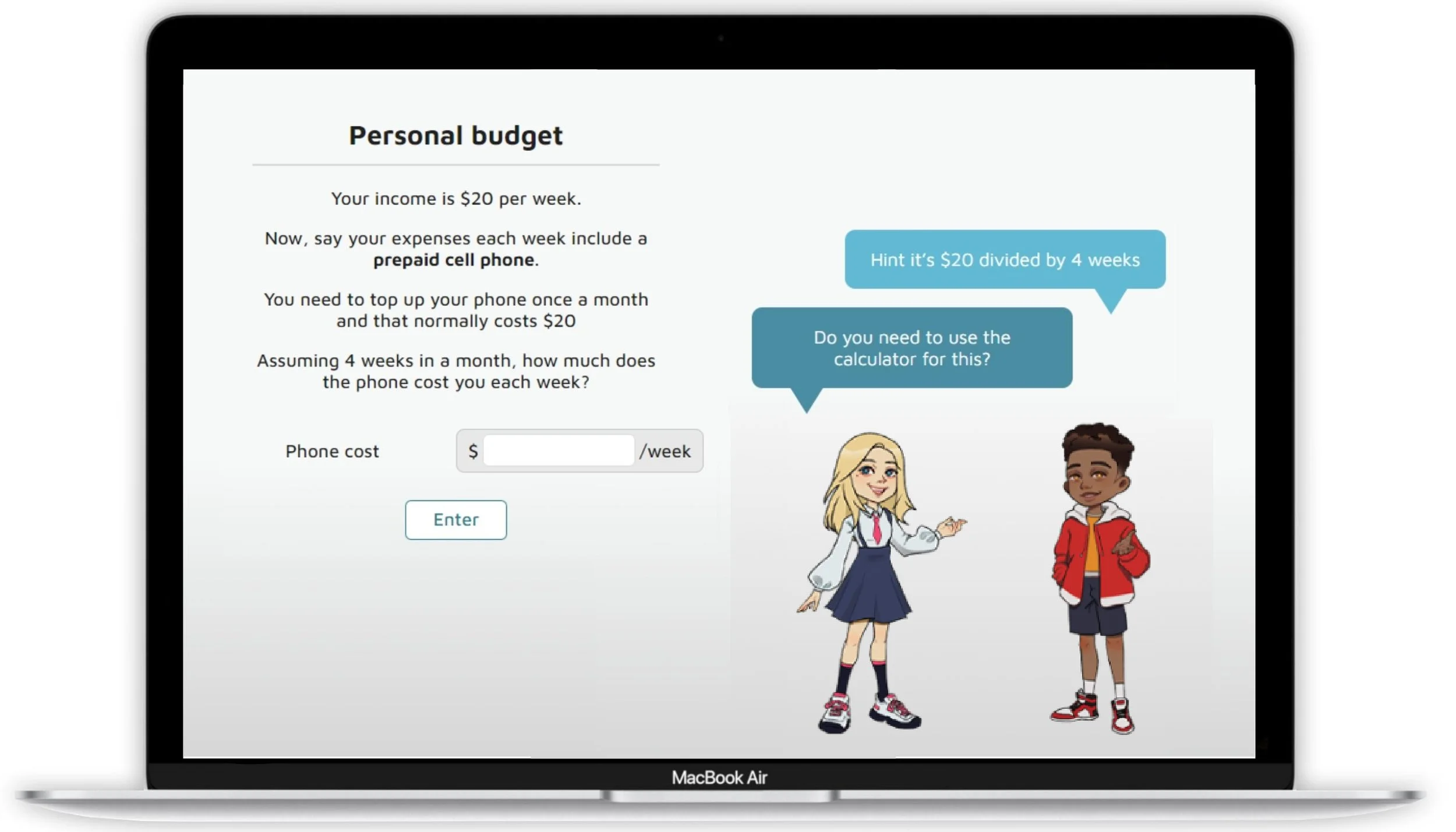

Our home-ed financial literacy curriculum contains 30+ interactive self-taught lessons.

Combined with a fun money management game that enables your child to learn by making their own financial decisions.

It couldn’t be easier for you and you can rest easy knowing they will gain the knowledge and confidence to be responsible for their own financial outcomes as they grow up.

Why choose MoneyTime for your home-ed financial literacy curriculum?

1. Simple to use

MoneyTime is wonderfully intuitive. Account creation is simple then there are friendly prompts through-out. Your child will have no problems getting started or navigating around the programme on their own.

2. Independent study

The programme is 100% self-directed. No lesson preparation or oversight is required by you, your child can work through the programme independently at their own pace.

3. Parental involvement

But.. if you’d rather be hands on you can do the modules with your child and use our lesson guides for discussion ideas and activities to maximise their learning experience. Parents tell us they often learn as much as their kids from the programme!

4. Easy to fit in

Lesson modules take just 20 minutes then an additional 10 minutes for playing the game. The half hour slots are easy to fit in your teaching timetable and for your child to stay focused.

5. Regular assessment

Fun multi-choice quizzes at the end of each module provide feedback for you both on how their financial literacy is improving. Quizzes are automatically marked and you have total visibility on your child’s progress and scores.

6. Proof of work

Upon completion they receive a certificate showing the topics they have covered and the time taken.

7. 100% relevant

MoneyTime has 100% localised versions for the UK, USA, Australia, New Zealand & South Africa, so you know what they’re learning is 100% relevant to them.

Your child will learn the basics of personal finance

MoneyTime will teach your child valuable life skills such as:

Preparing a simple budget

Avoiding bad debt

How people buy prog

Investing to create wealth

Making profit in a simple business

Protecting their wealth with insurance

and much more..

They will love this personal finance course for kids because..

It’s interesting and fun - your child won’t get bored, they’ll be begging you to let them do it

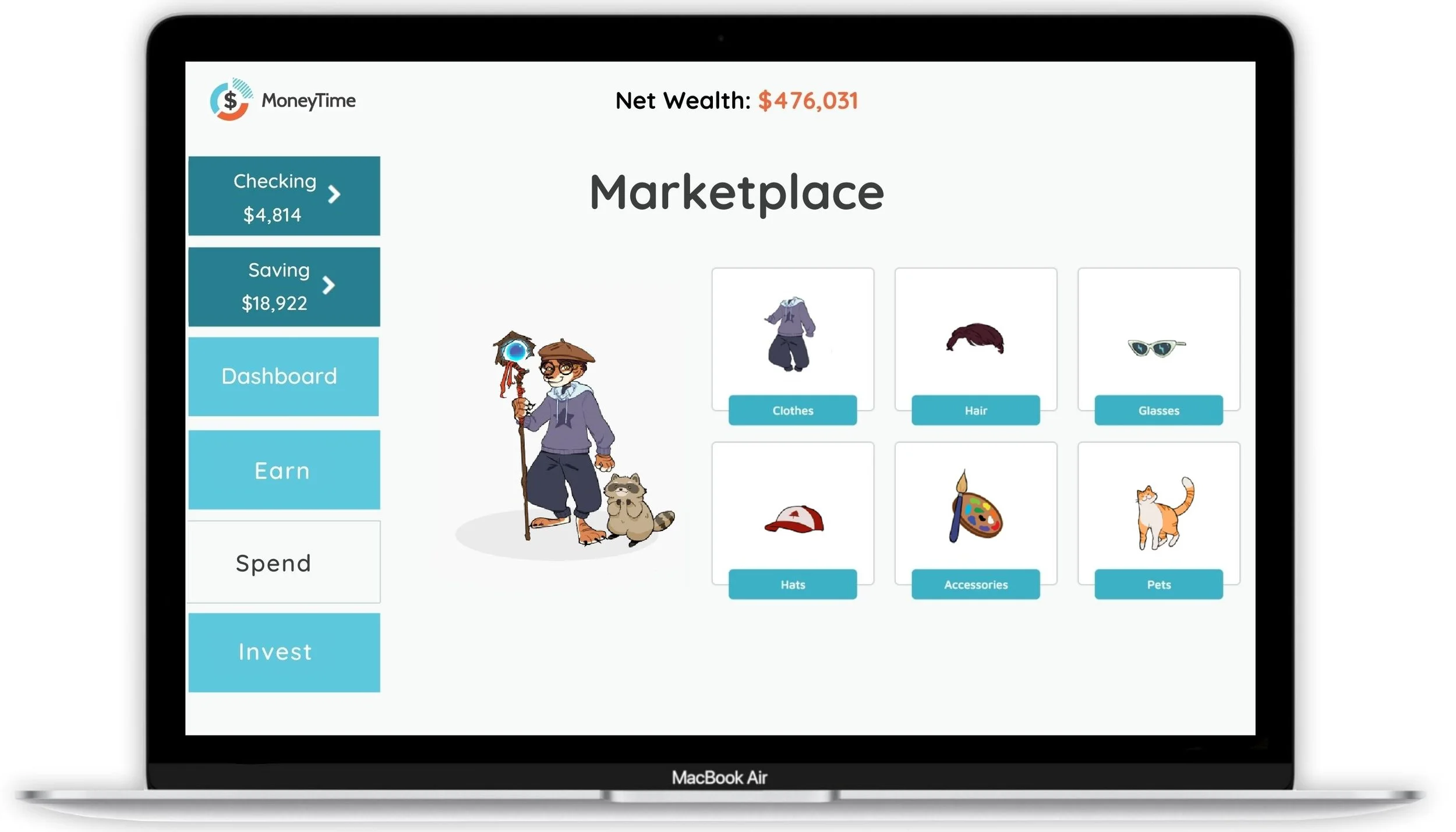

It’s gamified, meaning they get to make their own financial decisions with virtual money. The goal is for them to maximise their net wealth within the programme.

And see themselves climb up the leaderboard. You know how much kids love competitions!

They can also win achievements and receive printable certificates at the end of each topic.

Watch the demo to see for yourself

Watch a demo of MoneyTime’s home-ed financial literacy curriculum.

How MoneyTime’s home-ed financial literacy curriculum works

30 practical modules

From career choice, budgeting and borrowing, to property, investing and business, MoneyTime prepares your child for the real world by giving them a broad understanding of how money can work for them.

13 parent-child modules

Specifically designed for you to complete with your child. These are additional and optional but highly recommended as they put their learning into your family’s context and give your child an awareness of real living costs.

30 mins per module

It takes most kids less than 30 minutes to complete each lesson and play the money management game. Brief enough to hold your child’s attention and easy to fit into your home education schedule.

The money management game makes learning fun

Your child will be rewarded with virtual money for each correct answer to spend on avatars and investments within the programme.

There is a strong emphasis on having to choose between spending, saving, donating and investing – just like they will have to do in real life.

They get to see the consequences of their decisions and this experiential learning builds their confidence towards making good financial decisions in the future.

MoneyTime produces a 42% average improvement in knowledge

As measured by pre tests & post tests throughout the programme.

MoneyTime teaches financial values

Taking responsibility

MoneyTime teaches your child to take responsibility for their own financial outcomes. This means they will be less reliant on you for money when they grow up.

Delayed gratification

It teaches them the importance of delayed gratification, and that having money is a good thing because it gives them choices.

Giving to others

It also encourages them to think about others, and to help those who are less fortunate than themselves.

What home educators are saying about MoneyTime

You could spend hours scouring the internet for the best course on investing for kids or I could just tell you right now to head on over to the MoneyTime website and save you a whole heap of time and trouble.

— Tonya Nolan, homeschool blogger

The programme was easy for me to integrate into our home-ed schedule. We can do 2 or 3 lessons a week for about 30 minutes per lesson. Plus, my son can complete the programme independently, so I can work with my other kids while he learns.

— Ashley Fox, homeschool blogger

I love that my kids can experience money virtually first and practice their responses. I feel confident it will reduce many of the struggles that I had to face. They often lose track of time and end up completing more modules than asked so I know they’re enjoy it!

— Jessica May, homeschool blogger

How MoneyTime meets curriculum standards

MoneyTime contains equal amounts of literacy, maths & social education. It can be used as a unit study elective or as part of the personal finance component in any of the following subjects:

Maths, Social Studies, Economics, Business, Enterprise, Career Readiness and Consumer Science.

See below how MoneyTime incorporates the financial literacy curriculum standards for: the United Kingdom, the United States, Australia, New Zealand and South Africa.

Frequently asked questions

What happens after I purchase MoneyTime?

Once you’ve made your purchase you will receive an invoice and an email with instructions on creating your parent account. Then use the license key provided to create your child’s account. You both will be shown an introductory video then they’re good to go!

How much guidance will my child need to use MoneyTime?

None! MoneyTime has been built to be self taught. This means you can be as involved as much or as little as you want to be. You can leave your child to use the programme, or you can work through it with your child using the Study Guides provided.

How long will it take my child to complete the programme?

Approximate time to complete the course is 20 - 25 hours. We advise allowing 30 minutes per lesson. If your child completes 2 lessons (1 hour) a week, it will take them one and a half (1.5) terms to complete.

How do the Parent - Child modules work?

Within the programme, there are 13 Parent-Child modules specifically designed for your child to complete with you. They will write you a resume, a cover letter for your job, prepare a household budget and buy an imaginary house. The modules reinforce your child’s learning and are an opportunity to have some fun conversations about money and the future.

Is MoneyTime used in schools?

Yes MoneyTime is also used for teaching financial literacy to middle school students in schools

How can I manage or cancel my monthly subscription?

We have a customer portal that makes it easy to manage or cancel your subscription without needing to contact us. The link to the Customer Portal is included in every invoice you receive and on the footer of our website (called Parent Manage Subscription) so you can access it at any time.

Used by over 130,000 students

Awarded internationally

Children’s Education Program of the Year - 2022 Winner

Best Primary Product in the Global Edtech Awards 2025

Selected as one of the top 100 education innovations in 2023

The Money Awareness & Inclusion Awards - 2022 Runner-up

60-Day Money Back Guarantee

Try MoneyTime One Year Licenses completely risk free for 60 days.

If you are not satisfied with the programme, we’ll refund you in full.

Don’t leave your child’s financial future to chance

Personal finance is an immensely important life skill for everyone. You have the chance to give it to your child right now - when they are starting to make their own decisions with money. If they they acquire the knowledge and confidence to make good decisions now, their financial future will be less stressful, more secure, and ultimately a lot brighter!

Put your child on the path to financial independence

MoneyTime has custom versions for these countries. Select your preferred version at checkout.

New Zealand

South Africa

United Kingdom

United States

Australia